Bitcoin price corrected to $67,500 before investors were accustomed to the bullish move above $70,000 mid-week. This followed the previous week’s fall to $64,500. Weighed down by the hotter-than-anticipated inflation in the US based on the CPI report, Bitcoin struggles to hold above the $70,000 support let alone sustain the uptrend ahead of halving.

The largest cryptocurrency hovers at $70,775 during US business hours on Friday majorly buoyed by rising Bitcoin ETF net inflows and the upcoming approval of similar ETF products in Hong Kong next week.

Hong Kong’s Bitcoin ETF $25B Demand

Hong Kong, a global financial metropolis known for its significance in outbound Chinese investments, is expected to approve several Bitcoin ETFs in the coming week.

According to a report published by Matrixport, a Singapore-based crypto services company, the move could pave the way to a handsome $25 billion demand for Bitcoin, driven by Chinese investors.

The demand likely to be channelled through the Southbound Stock Connect program, will appeal to investors in mainland China allowing them access to Hong Kong-listed shares.

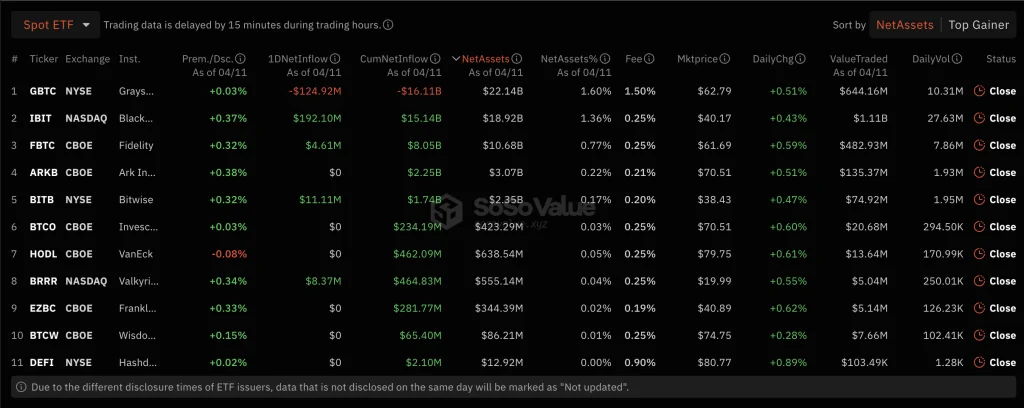

Bitcoin price rally in 2024 was mainly fuelled by increasing demand after 10 BTC ETFs went live in the US in January. Based on data from SoSoValue demand is still in the green with $91.27 million of daily total net inflow recorded on April 11. Despite Grayscale’s GBTC ETF still witnessing net outflows, $12.58 billion is the cumulative total net inflow volume for all ETF operators so far.

Speculating on the upcoming approval of Bitcoin ETFs in Hong Kong, Matrixport projected in the report that they could “attract several billion dollars of capital as mainland investors take advantage of the Southbound Connect program, which facilitates up to 500 billion RMB (HK$540 billion and $70 billion] per year in transactions.”

It is estimated that fresh demand for Bitcoin ETFs could reach $25 billion or “200 million Hong Kong dollars,” in the event there are no restrictions. Moreover, it has not been determined whether mainland Chinese investors can buy and sell spot Bitcoin ETFs.

Nonetheless, the outlook seemed positive on the backdrop of soaring gold prices, especially in Shanghai.

Bitcoin Price Analysis As 21,000 Options Expire

Bitcoin price managed to reclaim the $70,000 in the wake of a market shake-up due to the worrying inflation data in the US. The inflation which grew by 3.5% annually beating expectations of 3.4%, implied that investors will have to wait longer for the first Fed rate cut in 2024.

Although market sentiment remains positive thanks to the upcoming Bitcoin halving, the expiry of 21,000 BTC options with a Put Call Ratio of 0.62, according to blockchain data tracker Greeks.live could derail the uptrend.

The options carry a “maxpain point of $69,000 and a notional value of $1.5 billion.”

This comes amid heightened volatility levels in the crypto market with Bitcoin pivoting between the mid $60,000 range and the lower $70,000 range. Moreover, a noticeable surge in sell calls hinged to the halving may further increase volatility.

On the four-hour chart, Bitcoin lacks the momentum to validate an ascending triangle, with a breakout potential of 13.23% to $80,726. The 200-day EMA (blue line) functions as the immediate support with the trend favoring the bulls, thanks to BTC’s position above the previous day’s open at $70,005.

While a bullish breakout is highly likely due to strong fundamentals, it might be too early to rule out a correction seeking support and liquidity at the 200-day EMA (purple line) or $67,156 on the chart.

GIPHY App Key not set. Please check settings